Required Student Employment Forms

Updated 8/2022

After obtaining a student employment job and accepting the job offer in JobX, you must complete required employment paperwork prior to your first day of work. Please note that you may not begin working in any capacity (including training or volunteering) until your employment paperwork has been processed.

If you are interested in working at Swarthmore, we highly recommend reviewing the information below so you have the appropriate eligibility documents on campus.

I–9 Form | I–9 Identification Documentation | Direct Deposit Form | W–4 Form | Residency Tax Certificate (PA-EIT) | Workers Compensation Form

I–9 Form

- The I–9 form confirms your eligibility to work in the United States. More information on the I–9 form can be found here.

- This is completed through your JobX dashboard.

Identification Documentation for the I–9 Form

*Please note that copies or photographs cannot be accepted

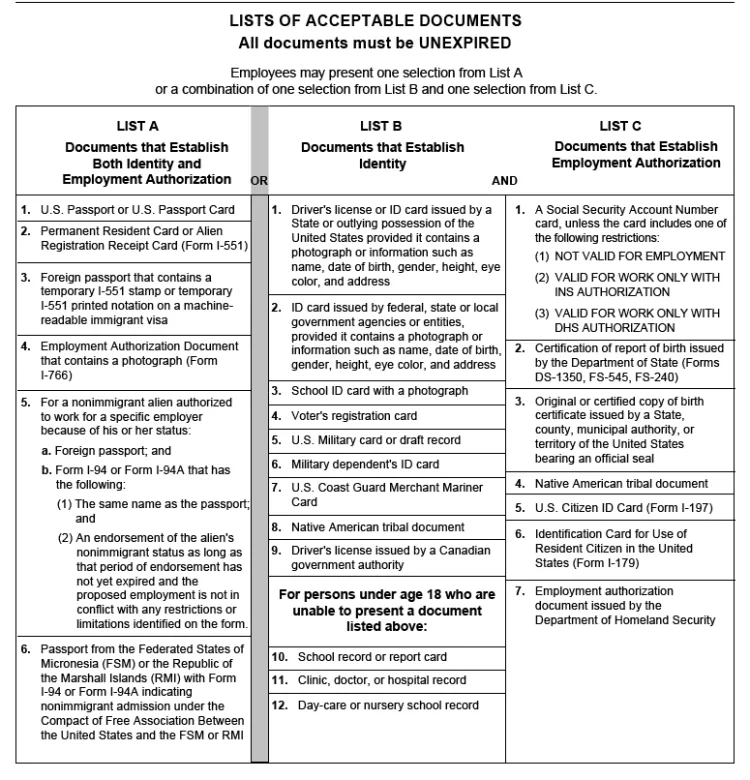

On the last page of the 1–9 Form there is a list of identifying documents that demonstrate you are eligible to work in the United States. Depending on your citizenship status and place of residence, you are required to bring:

- EITHER one document from those listed in column A.

- OR one document from those listed column B and one document from those listed in column C.

- International students must have their foreign passport and I-94 to complete this form

- These documents will be uploaded via your JobX dashboard AND need to be reviewed in person with the Student Employment Office prior to starting work.

Direct Deposit Form

- You are required to sign up for Direct Deposit to work at Swarthmore. This form determines where your pay will be deposited.

- You will need to know your bank account number and routing number to complete this form.

- You will complete this form via your JobX dashboard.

W-4 Form

- The W–4 form determines how much federal tax to withhold from your wages.

- This form is completed electronically via your mySwarthmore account once you are hired on campus. No upload or paper copy is needed.

- Here are instructions for creating, updating and printing your W-4 [PDF].

W-4 Information for New Student Employees

You will not be able to complete or update your W–4 document until you are entered into the Swarthmore Human Resource system as an employee. When your employment record has been created, you will receive an e-mail notifying you that you should complete your W-4. Once you receive that e-mail, follow these steps:

- Log into mySwarthmore using your network credentials.

- Select the link for Employee Main Menu

- Select the link for Tax Forms

- Select the link for W-4 Tax Exemptions/Allowance

W-4 Information for Returning Student Employees

A returning student employee is anyone who has previously held a campus job and was paid through the College. As a former employee, your W-4 form from your previous College employment will remain in our system and be available to you to review and update as needed through mySwarthmore. If the information is correct, you do not need to take any action. The Student Payroll Office may not give advice or guidance on how many exemptions you should take, or how to fill in the W-4.

Please note, as a returning employee, please note that you will not receive any notification to verify or update your W-4 information once it has been in put in our system.

W-4 Information for International Student Employees:

International Student Employees will complete required hiring paperwork during the International Student Orientation. If you are a current student and you have not completed your paperwork or have questions, contact the Student Payroll Office.

Residency Tax Certificate (PA-EIT)

- The PA EIT form is used by employers to verify an employers residence. Employers with worksites located in the state of Pennsylvania, like Swarthmore, are required to withhold and remit the local Earned Income Tax (EIT) on behalf of their employees working in the state.

- This form must be completed with your HOME address, not the address of the College, and you must fill out this form even if your home residence is not located in the state of Pennsylvania.

- You will complete this form via your JobX dashboard.

Additional Tax Forms

- Student workers from New Jersey, Ohio, Maryland, and Virginia will need to review and decide if they wish to complete additional tax forms to work in the state of Pennsylvania.

- These forms will be displayed on your JobX dashboard for review if applicable.

- Please contact the Student Payroll Office with any questions.

Worker's Compensation Form

- You will complete this form via your JobX dashboard.