- When will my deposit begin?

A pre-notification test is done during the next payroll cycle after an employee returns a completed direct deposit form to the Payroll Office. This test is to ensure that bank routing information is accurate. It is only a test. A direct deposit transmission will not be executed and the employee will receive a regular paycheck. If the pre-notification process is successful, direct deposit will begin the following pay period.

- When will I receive my W-2 form?

We are required by the IRS to post mark all W-2 forms by January 31st. All W-2 forms are mailed or made available online by that date.

- What if I do not receive my W-2 form or lose my form that was mailed to me?

W2's from 2023 onwards are available via the ADP portal. Instructions on how to access these are available here.

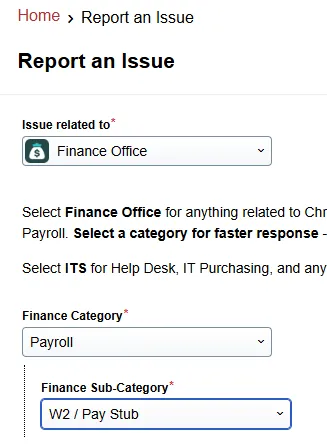

If you would like to request a W2 for year 2022 or prior please submit a request via the IT support portal - select 'Report an issue' and complete the boxes as shown below. Security questions will be asked to verify your identity. Once the online form is completed, we aim to respond within 48 business hours.

- Where can I get a copy of my paystub?

Please go to mySwarthmore employee main menu to view and print a copy of your paystub.

- How should I complete my W-4 (Employee's Withholding Allowance Certificate) form? How many allowances can I claim?

As tax and financial circumstances vary from person to person, it is not possible for Payroll to make a determination regarding an individual's tax liability. You can go to the IRS website to their "Withholding Calculator" page and enter your information. This will help you to determine if you are having the correct amount of Federal tax withheld from your pay.

- How do I sign up or change my direct deposit?

Complete our direct deposit form and return via email to jkoenig1@swarthmore.edu or swatts1@swarthmore.edu . You can also bring the form in person to 101 South Chester Road, 1st Floor, Payroll Office.

If you are unsure of your account and routing numbers, please contact your bank to verify.