An Index of Well-Being

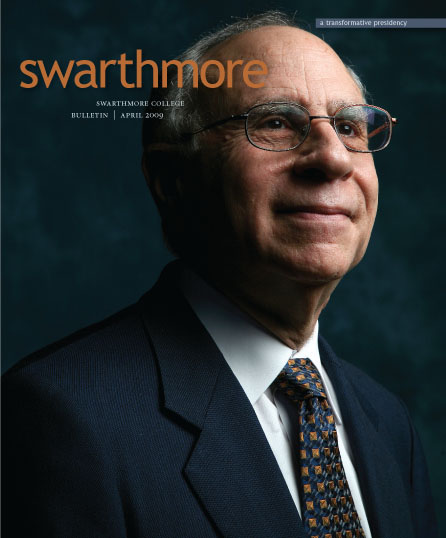

Imagine a scenario where U.S. domestic policy is defined less by profit, consumerism, accumulation of wealth, and self-interest than by a desire for general well-being. Sound utopian? Maybe. Yet according to Barry Schwartz, Dorwin P. Cartwright Professor of Social Theory and Social Action, the idea is by no means far-fetched. In fact, it’s one he’s been mulling over for quite a while—ever since he read an article by Martin Seligman, director of the University of Pennsylvania’s Positive Psychology Center, and Ed Diener, a professor of psychology at the University of Illinois and world expert on studies of well-being.

Imagine a scenario where U.S. domestic policy is defined less by profit, consumerism, accumulation of wealth, and self-interest than by a desire for general well-being. Sound utopian? Maybe. Yet according to Barry Schwartz, Dorwin P. Cartwright Professor of Social Theory and Social Action, the idea is by no means far-fetched. In fact, it’s one he’s been mulling over for quite a while—ever since he read an article by Martin Seligman, director of the University of Pennsylvania’s Positive Psychology Center, and Ed Diener, a professor of psychology at the University of Illinois and world expert on studies of well-being.

“They suggested that we need some kind of measure to replace, or at least counterbalance, the current measures of gross domestic product (GDP)—a measure of gross national well-being,” Schwartz says.

Although wealth has a considerable impact on life satisfaction, its effect begins to diminish after a certain point, Schwartz says. Yet U.S. economic policy and the American psyche are both tuned to devote a tremendous amount of time and effort into increasing per capita wealth. The two main reasons for this, Schwartz explains, are that people can use money to buy whatever makes them happy, so it becomes a kind of proxy for everything else; moreover, money can easily be measured, whereas the measure of well-being is more difficult to define.

“My take on this,” says Schwartz, “is that GDP is not only inadequate, but that policies aimed at increasing per capita wealth may be implemented yet are counterproductive because they get in the way of other things that really do make people happy, more satisfied, and able to lead more meaningful lives.”

And it’s now, in a time of economic crisis, that Schwartz believes that psychology could be at least as useful as economics in figuring out how to reduce the fear, anxiety, and distrust that have grown in Americans today and foster a more contented society, in which striving for monetary profit is countered, maybe even diminished, by altruism and desire to do the right thing.

“Fear, anxiety, and distrust are all psychological states,” Schwartz says. “These are not easy problems to solve, but when the solutions come, they’re not going to come from economists. It became quite clear to me, not only that we ought to be worrying about well-being in general but that we need to be listening to psychologists—to solve even economic problems. How do you get people to spend more? To save more? How do people track their wealth? Make spending and saving choices? When and why do they feel secure or insecure? We know a lot about that, and it could influence the way in which policy is shaped to promote savings or spending or whatever needs to be promoted.”

Moving beyond the national economy, Schwartz considered President Barack Obama’s domestic policy objectives on energy, education, and health care and realized that invariably questions arise for which psychology can provide meaningful answers.

“A Council of Psychological Advisors would have something useful to say about every single domestic issue that President Obama seems to think about,” Schwartz says. Schwartz envisions a group of six or seven experts in all the main areas of policy—a “stable of psychologists” on call to add their expertise to whatever problem is currently on the table. He is cautiously optimistic about the proposal, particularly because he recognizes in the new president someone who is willing to listen to new ideas.

“President Obama’s mind is already open and prepared for the sorts of things I think psychologists could contribute to,” Schwartz says.

And Washington is already nibbling. After publishing an article about his thoughts in the Philadelphia Inquirer and in a blog he keeps on the Psychology Today Web site, Schwartz received a message in early February from a staff member at the Center for American Progress—a liberal think tank dedicated to developing ideas to help shape policy—inviting him to expand upon his ideas.

“We’ll see what transpires, but it’s more response than I expected to get,” Schwartz says.

You can find Barry Schwartz’s Psychology Today blog at www.swarthmore.edu/x17560.xml

How Psychology Drives the Economy

Who could possibly imagine that the outcome of a soccer tournament could have an effect on economic perceptions? Sounds wacky? Not according to Assistant Professor of Economics David Huffman, an expert in the relatively new field of behavioral and experimental economics.

In a 2006 paper, Huffman and three fellow economists showed that the outcome of the FIFA World Cup, held in Germany that year, systematically affected “individual perceptions about economic prospects, both on a personal and economy-wide level.”

Using the international soccer tournament as a natural experiment, the group conducted interviews, soliciting opinions on economic expectation from 3,231 Germans. Each interviewee was contacted once before the tournament began and again after each of the seven matches in which the German team competed. The results indicated that “the unexpectedly good performance of the German soccer team [seeded 19th before the tournament and finishing in third place] improved both economic perceptions and expectations.”

The authors concluded that their data implied strongly that “much of the economic action is driven by psychology.” In 2007, Huffman, as co-author of another paper, wrote that the inability of economic models to accurately predict important aspects of the labor market is attributable to their failure to take emotion into consideration.

Huffman has incorporated his ideas into two courses this year: the fall semester seminar Behavioral Economics and the spring semester course Experimental Economics. He says that although he’s interested in human psychology for its own sake, as an economist he remains primarily focused on economic decision-making and understanding how markets work, using psychology to help further that understanding.

Putting his scholarship to work in the classroom, Huffman invites students to participate in hands-on research in the area of decision-making and risk-taking. “We offer different safe or risky options, involving real money, and try to see how willing someone is to take a risk and why or why not,” he says.

“The hallmark of an economic experiment, as opposed to a psychology experiment, is that we use money. We’re maybe too much obsessed with money or having money be involved, partly because it makes it more like a real economic decision. The amounts are not gigantic, but it is real money.”

Huffman’s research reveals intriguing relationships between risk taking and personal traits. For instance, people who are taller are more willing to take risks. “It’s well known from previous research that taller people tend to earn higher wages,” says Huffman, “and one explanation has always been that height fosters self-confidence. Perhaps the greater risk tolerance of tall people also reflects this confidence effect. Of course there are always exceptions, like Napoleon.…”

Hired in 2008 to add his expertise in the up-and-coming field to the College’s course offerings, Huffman says: “There’s even a bit of backlash against the field now, which means it’s being taken relatively seriously. It’s a neat field—and, I think, a ‘hot’ one right now.”

—Carol Brévart-Demm

For more information on David Huffman and his research, visit www.swarthmore.edu/x16527.xml.

Email This Page

Email This Page